Teaching Children About Money

Teaching Children About Money

There are so many things parents look forward to as their children begin to grow up. First steps, first laugh, and first days of school are exciting milestones to reach, but the lessons kids learn at home are even more meaningful. When they reach 5 years old, parents should consider teaching them the value of money and how to handle it. If you're not sure where to start, read about these seven steps to teach your child good financial habits. If you start early, they will be set up for greater success later in life. Prepare for their future by introducing good money habits now. We hope that this Teaching Children About Money post inspires you.

6 Tips to Raising Kids who Value Money

Teaching Children About Money

Teach Them at Home

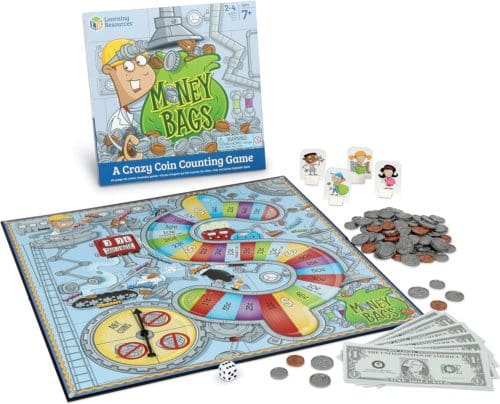

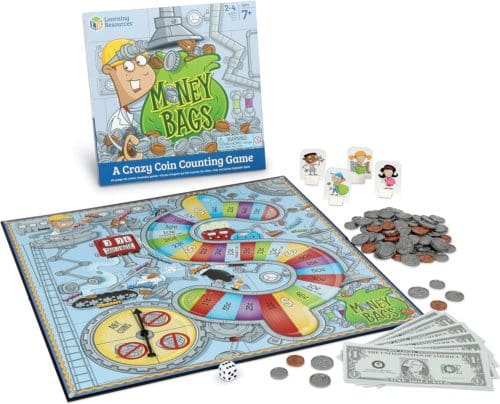

Kids often learn about money in their early elementary school years, but you don't need to wait for a certain grade. Instead, teach them at home by introducing them to bills and coins. Point out how each bill is worth a different amount and show how to add coins. As long as your child learns to tell the different coins and bills apart, they'll be well on their way to understanding how to handle money. An easy way to do this is to buy a board game that uses fake money or get a play cash register with plastic coins they can play with as these are good money games for kids.

Learning Resources Money Bags Coin Value Game

Lead by Example

Parents constantly lead by example, even when they don't realize it. Kids watch everything and soak in the habits you exhibit, which is an easy way to show them how to understand and use money. When you buy food at the grocery store or fill up your gas tank, point out how much the purchases cost and have them help you count out the cash to pay for it. You can also tell them when and how you get paid for your job. Introduce them to the concept of working for pay and buying things in the real world to put your at-home lessons into action.

Learning Resources Pretend & Play Calculator Cash Register

Start an Allowance

It will take a while for your child to get their first job, which is why many parents start an allowance for their kids. Establish what they need to do each week by printing a chore chart where they can check off each task they complete. Give fun stickers to mark each finished chore and write down how much they earn each time they help around the house.

Saving Jar

Create Money Jars

Another way to make finances a visual experience is to create simple money jars that are labeled for saving, spending, and sharing. Kids enjoy watching their money grow as they save or put money aside for spending. They'll also get into the habit of saving to share, which they can give to their school drive, their church, or a local charity. These are healthy financial habits to start while they're young, so they continue saving money for these reasons when they're older.

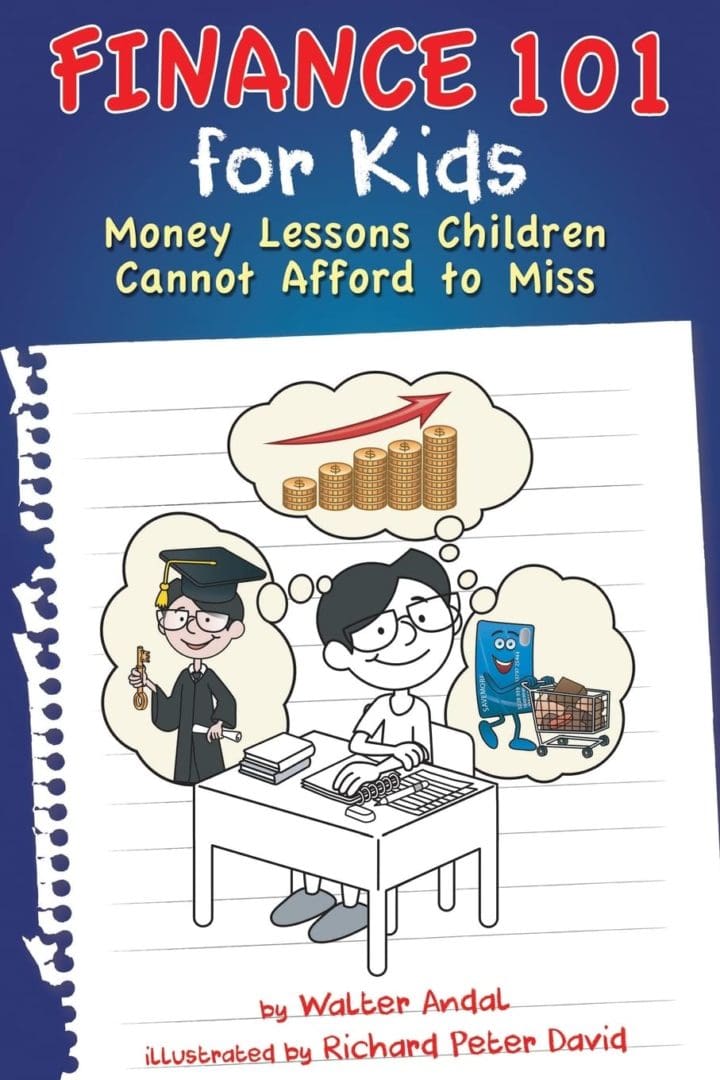

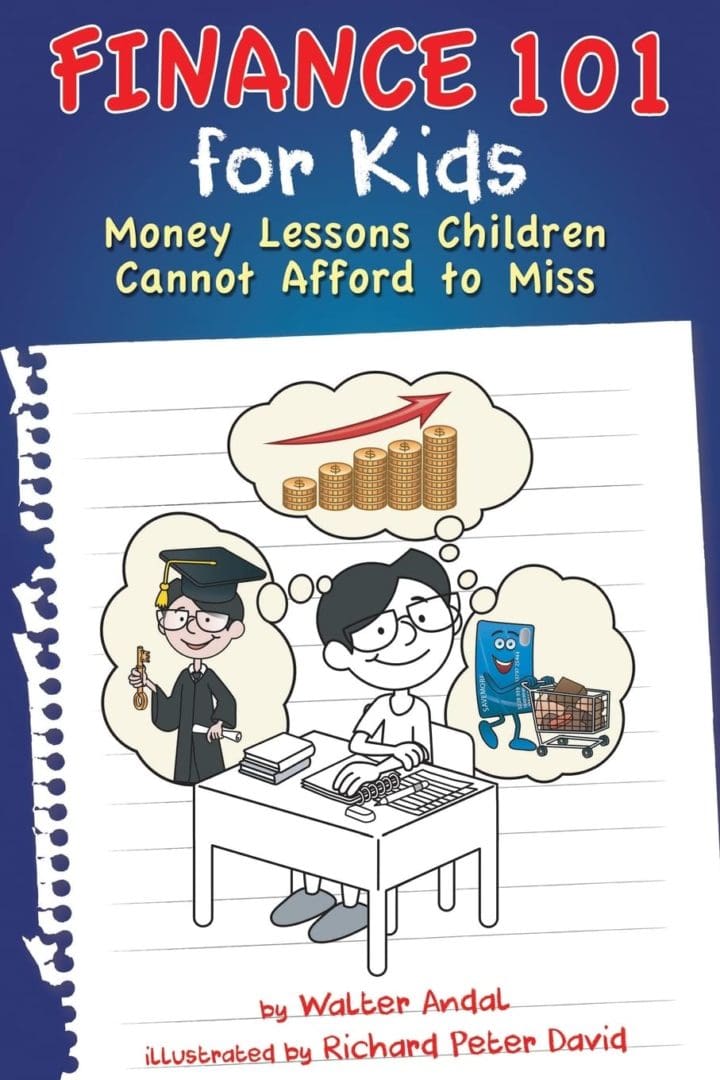

Finance for Kids Money Lessons Children Cannot Afford to Miss

Talk About Saving

Once your child has started earning money, talk with them about saving. What do they want to save for? It might be weekly school lunches or a new video game they love. Whatever it is, encourage them to collect over time for what they want. They'll learn about getting more out of their money in the long run if they set some aside now.

Introduce Interest Rates

Once kids start spending their own money and discover the joy that comes with buying something they want, they may begin to ask for more. Think about introducing the concept of interest rates to older kids when they want funds without working for it first. Give them $10, but tell them they'll need to pay an extra dollar back every week they don't repay you. Explain that interest rates cost them more in the long run if they borrow instead of save.

Ways to Save Money at Home

Match Their Savings

When your child gets their first full-time job, they may not understand how smart it is to open a retirement account where their company matches their savings. Teach them about that early by matching what they save for a certain period. When they're older, they'll be quick to jump on savings opportunities where their job matches what they put away.

Keep up the Habits

After you introduce your child to good financial habits, keep them up. Check in on the progress of their savings, encourage them when they do chores, and make visual savings jars to make money fun.

We hope that this Teaching Children About Money post inspires you. Good luck!

How to Spend Money Wisely

You May Also Like

Pingback: Clues that your partner may be cheating on you financially

Pingback: How to Trade Doge Crypto on Popular Cryptocurrency Exchanges?